Auction houses are seeing a significant increase in the number of repossessed properties for sale at auction. But is a repo always the best buy?...

For some first-time buyers, would-be property investors, and professionals alike, the words "by order of receiver for mortgages" are enough to get their pulses racing.

The chance to buy a repossessed property for sale at auction at as little as 60 per cent of what the mortgagor originally paid is certainly hard to ignore.

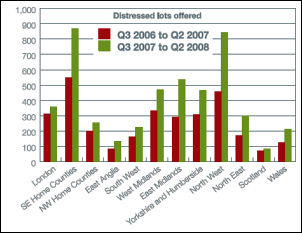

And, according to figures from Essential Information Group (EiG), the volume of

repossessed property

appearing at auction has risen by 100 per cent over the past 18 months, so it should be an ideal time to start bidding. But is it quite so simple?

Bargain Bidding At Repossessed Property Auctions

The obvious attraction in repossessed houses and flats is, of course, the temptingly low reserve, reflected in the guide price.

It’s low because although the lender has a duty to sell at the best price, time is money, and they will want to recoup their funds as quickly as possible.

The problem for a potential auction buyer is that a low guide price may attract so many interested parties that it results in a higher sale price.

In fact, it’s possible that you could find yourself paying over the market value because, according to David, there are many people who will be at an auction specifically with repossessions in mind.

So, are repossessed properties likely to be bargains? Yes, but only if no one else has noticed them and is bidding against you!

Wot No Bidders?

The EIG figures for August 2008 show that although the number of lots offered to auction was up slightly on last year, the number of sales achieved was only 55 per cent, down 14 per cent on August 2007.

Simon Zutshi, founder of Property Investors Network says: "Someone I know who went to a property auction recently told me that out of 30 lots only one sold."

But, says Simon, this is good news for serious investors.

"Previously auctions haven’t been a great place to get bargains because there were lots of amateurs who were willing to pay too much.

"But once again they’re a good place to find deals either before, during, or after the sale."

The latest RAPID report from EIG and Allsops bears this out and suggests that more repossession bargains will emerge in the months ahead:

The latest RAPID report from EIG and Allsops bears this out and suggests that more repossession bargains will emerge in the months ahead: "Despite the rapid increase in numbers of distressed sale lots, a significant proportion of repossessed properties offered at many auction houses remains unsold.

"This is largely due to overpricing in an increasingly weak market.

"We anticipate that the success rate will improve as lenders face up to the need to price attractively to achieve results in the face of the inevitability of rising numbers of loan failures and increasing net monthly possessions over sales.

Des Res or Repo Property Disaster?

If you decide to try and bag an auction repo, what kind of properties can you expect to find?

According to Essential Information Group (EiG) the type of homes sold at property auctions has changed recently, with smaller lots, particularly flats, more prevalent.

In terms of condition, David Lawrenson, who runs the property training and education company Letting Focus, says prepare yourself for the worst.

"In general it would be most unlikely to find a repossessed home that’s spankingly clean and tidy! Repos may be in a bad state, but you can assess that when you go and view."

But more importantly, as with any properties sold at auction, they may have serious structural or legal issues. "For the uninitiated, property prices at auctions seem low, but there is usually a good reason," warns David. "Many properties are in poor condition, have subsidence, are blighted by proposed road developments, have been occupied by squatters, have sitting tenants, or have defects in the legal title. Or they may just be unique and therefore hard to value."

That said, auction houses are also seeing a lot of new-build properties coming under the hammer, and these may well be in much better shape.

How To Find Out About Repossessions?

There are over 200 property auctioneers in the UK, so registering with them all may be a little time consuming. By signing up with local auctioneers you will receive details of relevant properties. However, regional homes are sometimes auctioned in London or other large cities, where they will probably attract less interest and may achieve a lower price.

For the full picture, the excellent EiG property auctions website covers all UK auctions and allows you to search specifically for repossessions.

Other Ways To Find A Repossession?

The thrill of auction day isn’t for everyone, but there are other, less blood-pressure-raising ways to find and buy repossessions.

1. Ask your local estate agent

Potential auctions properties are usually offered to estate agents first, so invest some time building a relationship with your local estate agents so they see you as a serious buyer if a property comes up in your area.

Also, keep a lookout in the local papers for properties asking for ‘best offers’ by a certain closing date.

2. Buy before the sale

Many auction properties will be open to offers before the day of the sale. Look out for sales details that state ‘unless previously sold’. If you’re lucky you may be offered a repossessed property at little more than the reserve price.

3. Buy after the sale

If a property doesn’t sell the auctioneer will often have the vendor’s authority to sell it at the reserve price for up to 24 hours after the auction.

Caveat Emptor

As with any property for sale at auction, it’s a case of buyer beware, so do your homework.

The legal side of the sale should be straightforward when buying from a lender, but beyond that it’s down to you to check that you know exactly what you’re buying and that you’re ready to do business.

1. Go and see the property: You may have to go as part of a block viewing, but at least you’ll see your fellow bidders.

2. Paper Work: Before the day, get the property surveyed and legal checks completed. Be on the lookout for special conditions in the memorandum of agreement.

3. Finance In Place: Have the mortgage and insurance ready. You’ll only have 28 days to complete, and delays could lose you the property and your deposit plus the cost of re-auctioning it.

4. Deposit: You’ll need to pay a ten per cent deposit when the gavel falls, so make sure you have it with you.

5. Keep Your Head: Decide how much you’re willing to pay and stick to it.

Advice for People Facing Repossession

If you are having trouble paying your mortgage bills you shold act quickly to avoid repossession. For more information and advice, visit:

- Consumer Credit Counselling Service

- Citizens Advice Bureaux

Michael O'Flynn

Related stories:

A Guide to Buying at Auction

If picking up a bargain really gets your juices flowing, then buying a property at auction may be just the thing to send the adrenalin coursing through your veins...

Sealed Bids: A Buyer's Guide

Gone are the days when an asking-price offer secured the house of your dreams. Today you may have to compete in a nerve-wracking sealed bid auction...

Estate Agent Fees: A Beginner's Guide

Estate agents' fees - it's hard to avoid them, but understanding the lingo and reading the small print can save you serious cash...

The article on repossession is supportive. Described very well about repossession ways

ReplyDeleteBuilding Renovation Services